The latest buzzword in eCommerce around the world is ‘Quick Commerce’. From groceries to other daily use items, Quick Commerce comes with the promise of fast delivery within same-day or even 10-min. It has pioneered the next generation of delivery.

In India, the quick commerce deliveries by a logistics firm jumped by 500% in Jan alone. A host of retailer apps and platforms are coming up with the promise of on-demand goods delivery at the doorstep.

This article addresses many of the questions about Quick Commerce — and provides some frameworks as you think about this space, and where to prioritize and place your bets.

What is Quick Commerce?

Quick commerce or q-commerce or on-demand delivery is the next generation of commerce. This business model focuses on delivering small orders of groceries, office supplies, or health and beauty items. Instead of using large warehouses located on the outskirts of town, companies are creating small storage facilities near the point of delivery.

Concept of Quick Commerce (Source: Delivery Hero)

What differentiates quick commerce from other models?

- Quick delivery, typically within 10-30 min

- Uses micro fulfillment centers or dark stores, typically catering within a 2km radius

- Small selection available

Evolution of Quick Commerce (Source: Delivery Hero)

How big is Quick Commerce?

Grocery delivery services—such as Gopuff and Zapp—are fairly common in many major markets. U.S.-based GoPuff delivers in only 30 minutes and is worth $15 billion. Their European competitors, such as Berlin-based Gorillas, are growing fast and getting lots of new customers.

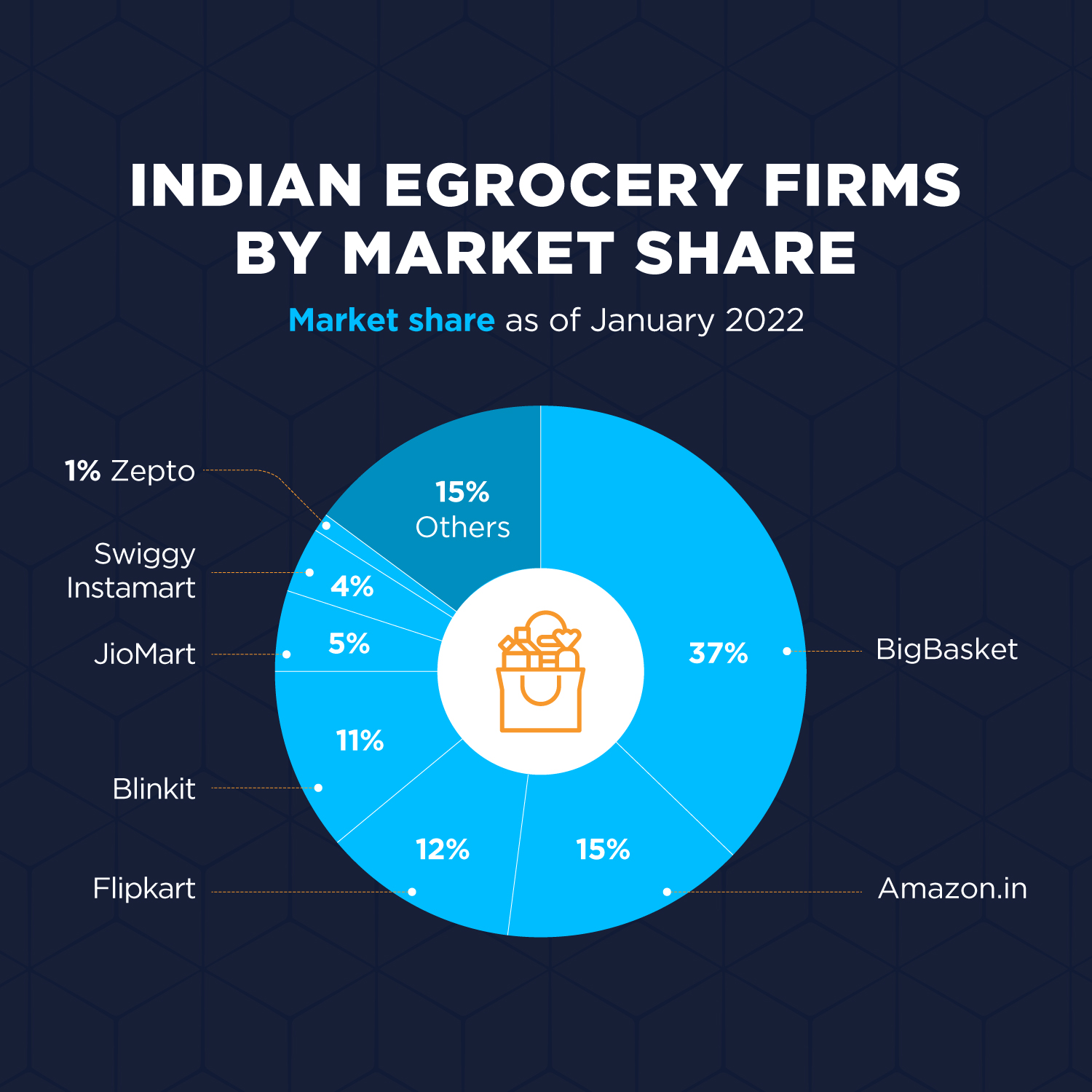

Q-commerce is quickly growing in popularity in India, too. The local quick-commerce segment appears to be up for grabs, with newer companies such as Zepto and established ones such as Blinkit making significant brand and positioning changes that are likely setting the course of this business model.

As per Redseer, India’s quick-commerce market is set to reach a size of close to $5.5 billion by 2025, growing 15 times its current size and leading other markets including China in terms of customer adoption. The TAM (total addressable market) in India for quick commerce is estimated at $45 billion. The demand is mostly from tier-1 cities and large metros that are driving demand on the back of mid-high-income households.

“Quick commerce is becoming the next major segment as players realize the massive potential it has. Emerging as one of the fastest-growing eCommerce models, quick commerce is fundamentally changing consumer purchase behavior and the grocery retail market on the whole by providing faster delivery options (in as little as ten minutes) as well as a more convenience-driven shopping experience,” RedSeer said in its note (Source: Business Standard).

Quick Commerce Business Models

The industry participants are heavily concentrated on the vertically integrated segment where players promise the delivery of goods within 10-15 min from their own fulfillment centers. However, there are many third-party delivery platforms as well that help in the last-mile delivery of goods.

- Delivery platforms: Companies such as Swiggy’s Instamart and Dunzo deliver products (mainly groceries) from third-party retailers to customers’ homes and businesses. In some cases, the companies pick up the orders in person; in others, they fulfill delivery by dropping off a package.

Benefits:

- Asset-light model: does not require fulfillment centers or supplier relationships before entering a new city

- More choice: since they procure from multiple 3rd party retailers, the choices available are more

Challenges:

- Out-of-stock: no clear and real-time stock visibility makes the items susceptible to out-of-stocks

- Limited operational scope: as the delivery platforms earn through per-transaction fees, they have lesser operational leverage than MFCs

- Vertically integrated models: such as Blinkit, Instamart, and Zepto. They manage end-to-end operations, from buying and storing inventory through picking and delivery to the end consumer.

Benefits:

- Speed of delivery: they are optimized for speedy deliveries, fulfilling the promise of quick commerce

- Visibility: clear visibility on stocks, quality, and pricing

Challenges:

- Demand: orders in an area depend on the needs and degree of population density. Plus, the rental cost is a big challenge, especially in tier 1 cities.

- Capital: requires capital to start operations in a new city

Key metrics | Vertically integrated instant needs | Delivery platforms– grocery | Traditional e-commerce |

Business model | Vertically integrated | Marketplace for local grocery stores | Vertically integrated and marketplaces |

Product focus | Essentials | Groceries, some nonfood retailers | Groceries and nonfood |

SKUs | 1,500–5,000 | 25,000+ | 100,000+ |

Delivery speed | 10–30 minutes | Same day (from ~35 minutes to several hours) | One to two days |

Curation | High | Low | Low |

Localization | Highly localized to individual neighborhoods | Localized to city | Not localized |

Warehousing | Micro fulfillment centers | N/A | Regional or local fulfillment centers |

Delivery methods | Individual deliveries, individual and pooled deliveries | Individual and pooled deliveries | Pooled deliveries |

Delivery model | Contractors or regular employees | Contractors | Employees/ third-party logistics |

Technology implementation | Merchandising, warehousing, logistics | Logistics | Merchandising, warehousing, logistics |

Market Players | Blinkit, Zepto, Instamart | Instamart, Dunzo | Amazon, many others |

Source: Coresight

Who are the top Quick Commerce players?

Top Quick Commerce Players in India

Source: Economic Times

How does the unit economics of Quick Commerce work?

At a broad level, the unit economics of vertically-integrated quick commerce companies can be modeled as:

Principal revenue source: | Product sales |

Plus: | Delivery fees |

Plus: | Courier tips |

Minus: | Product costs |

Equals: | Gross Margin |

Minus | Operating associate costs |

Equals: | Contribution Margin |

Q-commerce company’s expansion shows that they are taking advantage of the low cost of capital and burning through venture capital funds. The approach is costly since it requires paid drivers to deliver wholesale-owned products from manual, micro-fulfillment centers to local clients in less than 15 minutes. Add to that the proliferation of competitors – more variety, faster delivery, better prices – and we haven’t even discussed the battle for size and expansion through discounts provided to new or lapsed consumers.

Some factors which make the unit economics challenging:

- New customer acquisition/ offers for lapsed customers: Acquiring new customers is always a challenge for a new business. It can be hard and expensive. But we have seen businesses that lost money for years (read Amazon) before making a profit.

- Small orders: Q-commerce is mostly being adopted for the top-up baskets, i.e., for products that were missed in the monthly grocery list or are required for an emergency. Therefore, it’s mostly the small orders that the players have to deal with. This brings the operational costs up (delivery labor, picking & packing labor, material). But in order to get customers and compete with other players, the cost to customers needs to be low.

- Inventory: Q-commerce is available in tier-1 cities where the cost of real estate is not cheap. The supply chain is another issue that is critical in smooth running. One needs to have the correct product mix that appeals to local tastes.

In a survey done by Localcircles across 272 districts of India with 30,000 respondents, they found that: “Of the consumers who order groceries online, 49 percent said that selection and availability was an important criterion for them while ordering online. Only 8 percent of the respondents said that fast delivery was an important criterion”. - Labor cost: Mostly, the employees (contract + company’s employees) are on an hourly payroll with benefits. Q-commerce retailers need more employees to cater to the demand for small orders. Hence, labor cost is a big challenge.

Key Takeaway

Q-commerce is the natural evolution of eCommerce. As lifestyles across the world keep changing, so will customer behavior and adaptability. It’s not an easy game by any means. It is also not a game for the faint of heart. You might lose a lot of money quickly if you don’t plan carefully. The difficulty is how to make it a big necessity over time while maintaining a breakeven approach.