Since the COVID-19 pandemic, the eCommerce space has undergone tremendous changes as more shoppers turned to the internet for meeting their shopping needs & simultaneously giving rise to the desire for alternate & convenient payment options. Especially with young shoppers who were keen to explore new ways to pay for basic or luxury purchases while moving away from traditional methods like cash and credit.

One of the breakthrough methods which has quickly spread across & is favored by shoppers across age groups is what we often call ‘Buy Now Pay Later’ (BNPL).

Buy Now, Pay Later (BNPL) has quickly risen to be an indispensable component of any e-commerce/DTC business as it allows customers to buy items instantly and offers the option to pay the total owing back in installments. According to a study, more than 51% of consumers used a BNPL service during the pandemic while the total BNPL market is slated to surpass the $150 billion mark by 2025 and is expected to reach $3 trillion by 2030.

How does it work?

At checkout, shoppers are provided the option to get the product shipped right away although them having to pay for it in full or in part after some days or weeks & in smaller installments over time for the remainder of the amount. Shoppers typically make 5 or 6 equally spaced installment payments taken directly from their payment source, hence nullifying the extra fees or interest they would have to pay, provided they pay on time. Adding to this, the participating merchants pay the provider a 2–6% commission plus a fixed fee for every transaction.

Top reasons consumers opt for the BNPL option while shopping online –

- To avoid paying credit card interest

- To buy things which otherwise wouldn’t fit in the budget

- To borrow money without a credit score check

- Do not use/have a credit card

Historically, the target market for BNPL has been the younger generations, Millennials and Generation Z. According to a study by Forbes, the growth of BNPL among Gen Z has grown 600% since 2019, while the rate for Millenials has grown more than 3X

While Gen X and Baby Boomer adoptions are also growing significantly, it’s the growth of BNPL driven by younger generations will lead it to become a primary payment method in the near future rather than an alternative payment option.

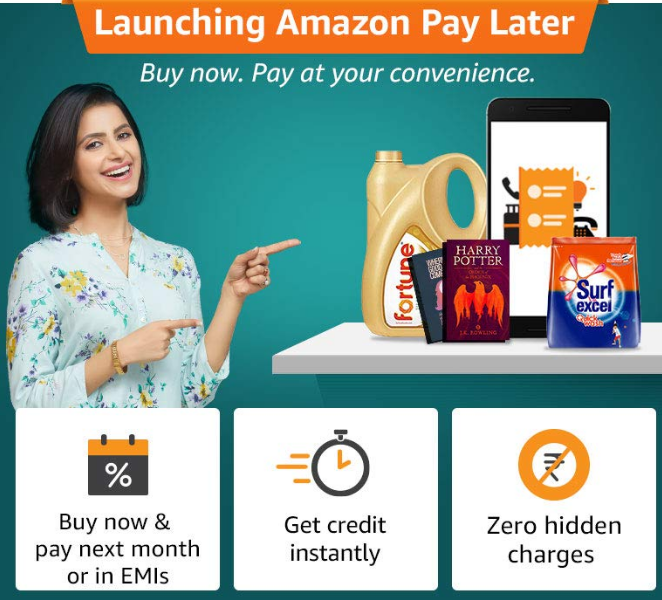

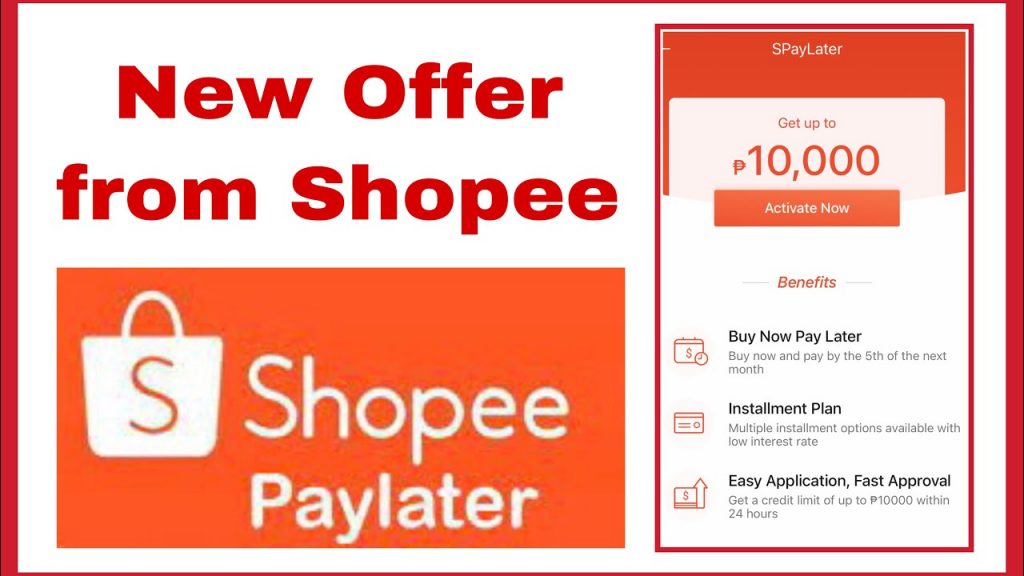

Brands big or small are embracing BNPL

Many leading retailers irrespective of size, offering & markets they operate are adopting BNPL to better serve their customers & as a result, achieve higher conversions and reduce cart abandonment.

Buy Now, Pay Later Benefits

For Shoppers

Incredibly convenient – For consumers who are wary of credit cards and typically don’t carry cash, BNPL offers a convenient, flexible payment option.

No Hidden charges & Interest-free payments – The BNPL options provide an affordable payment option since it carries no/limited fees and interest rates, unlike credit cards making a profit out of the interest rates and late fees.

Flexible solution than credit cards – Shoppers are seen to be gradually moving away from traditional credit cards, due to hindrances such as high-interest rates, declining credit limits, and poorly implemented rewards programs making the entire customer experience a gruesome one.

For Retailers

Attracts more shoppers –BNPL is an inclusive payment experience that enables more shoppers to complete a purchase they perhaps couldn’t have bought otherwise

Enhanced customer experience – Aside from providing customers with the opportunity to get their digital products sooner, having a simple financing option like BNPL can also establish more brand trust with your customers

Higher conversions and Avg order value (AOV) – Businesses that offer BNPL services, see an average 20-30% increase in conversion rates. Moreover, 2/3rd of online shoppers have already used Buy Now, Pay Later for at least one purchase in the past year & have realized increased order value per basket.

Summary

As the younger generations are striving to gain purchasing power and as more no shoppers move away from credit cards, it is only a matter of time before the adoption of flexible payment options increases over time.

Buy Now, Pay Later well & truly presents a convenient & shopper friendly & at the same time flexible solution to disrupting the payments industry, luring shoppers away from credit cards and empowering them to spread payments for the purchase over time without having to bother about the inevitable interest fee accrual.

Get in touch with PiWheel

Our eCommerce solutions and the team of experts can help strategize your eCommerce brand’s journey in India, UAE, KSA, Turkey, SEA, and Australia. Connect with us in 1 step: